Are Auto Repair Tax Deductions possible? Absolutely! If you’re self-employed, a gig worker, or a small business owner, understanding auto repair tax deductions can significantly reduce your tax liability. AUTO-REPAIR-TRAINING.EDU.VN is your comprehensive resource for mastering these deductions, optimizing your finances, and advancing your career in the automotive industry. Explore opportunities for ASE certification, develop a solid business plan, and follow our step-by-step guide to financial success.

Contents

- 1. Who Can Claim Auto Repair Tax Deductions?

- 2. What Auto Repair Costs Are Tax Deductible?

- 3. How to Calculate Business vs. Personal Use?

- 4. What Records Should You Keep for Car Repair Tax Deductions?

- 5. What Are the Methods for Claiming Car Repair Tax Deductions?

- 5.1. Standard Mileage Method

- 5.2. Actual Expense Method

- 6. How to Choose Between the Standard Mileage and Actual Expense Methods?

- 7. Where to Report Car Repair Tax Deductions?

- 8. Claiming Car Repair Tax Deductions as a DoorDash Driver

- 8.1. Tracking DoorDash Mileage

- 8.2. Deductible Expenses for DoorDash Drivers

- 8.3. Filing DoorDash Car Expenses

- 9. What Are Common Mistakes to Avoid When Claiming Auto Repair Tax Deductions?

- 10. How Can AUTO-REPAIR-TRAINING.EDU.VN Help You Maximize Your Auto Repair Tax Deductions?

- 10.1. Comprehensive Training Programs

- 10.2. Business and Financial Resources

- 10.3. Career Advancement Support

- FAQ About Auto Repair Tax Deductions

- 1. Can I deduct car repairs if I use the standard mileage method?

- 2. What if I don’t have receipts for all my car repairs?

- 3. Can I deduct car repairs if I lease my vehicle?

- 4. Are there any limits to how much I can deduct for car repairs?

- 5. Can I deduct the cost of a car accident repair?

- 6. What if I use my car for both business and personal use?

- 7. How do I handle depreciation when deducting car expenses?

- 8. Can I deduct expenses for a vehicle I don’t own?

- 9. What if I’m audited and the IRS disallows my car repair deductions?

- 10. Where can I find more information about car repair tax deductions?

1. Who Can Claim Auto Repair Tax Deductions?

Are you eligible for auto repair tax deductions? Not everyone can claim these deductions, but several categories of individuals qualify. Understanding if you’re eligible is the first step to maximizing your tax savings.

- Self-Employed Individuals: Freelancers, independent contractors, and small business owners can often deduct car repair expenses.

- Gig Workers and Delivery Drivers: Those working for companies like Uber, Lyft, DoorDash, or Grubhub are typically eligible.

- Armed Forces Reservists: Under certain conditions, reservists may deduct unreimbursed vehicle expenses.

- Qualified Performing Artists: Performing artists with specific income and expense criteria can claim deductions.

- Fee-Basis State or Local Government Officials: Officials compensated on a fee basis may also qualify.

Note: Employees receiving a W-2 typically cannot deduct car repairs unless they fall into one of the categories listed above.

2. What Auto Repair Costs Are Tax Deductible?

What car repair costs qualify for tax deductions? To be deductible, car expenses must be ordinary and necessary for your business. According to the IRS, an ordinary expense is common and accepted in your trade or business, while a necessary expense is helpful and appropriate.

Here are some deductible car expenses:

- Repairs and Maintenance: Costs for fixing and maintaining your vehicle.

- Gas and Oil: Fuel and oil changes for business-related travel.

- Tires: Replacement tires used for business purposes.

- Registration Fees: Fees paid to register your vehicle.

- Insurance: Business-related portion of your auto insurance premiums.

- Depreciation: If you own the vehicle, you might be able to deduct depreciation.

- Lease Payments: A portion of your lease payments can be deducted if you lease the vehicle.

Important: Only the portion of these expenses related to business use is deductible. Personal use expenses are not deductible.

3. How to Calculate Business vs. Personal Use?

How do you determine the business-use percentage of your vehicle? If you use your car for both business and personal reasons, you must allocate expenses based on the miles driven for each purpose.

Here’s how to calculate the business-use percentage:

- Total Business Miles: Track the total number of miles you drive for business purposes during the year.

- Total Miles Driven: Keep track of all miles driven, both for business and personal use.

- Calculate Percentage: Divide the total business miles by the total miles driven. The result is your business-use percentage.

Formula: (Total Business Miles / Total Miles Driven) x 100 = Business-Use Percentage

Example: If you drove 12,000 miles for business and 20,000 miles total, your business-use percentage is (12,000 / 20,000) x 100 = 60%.

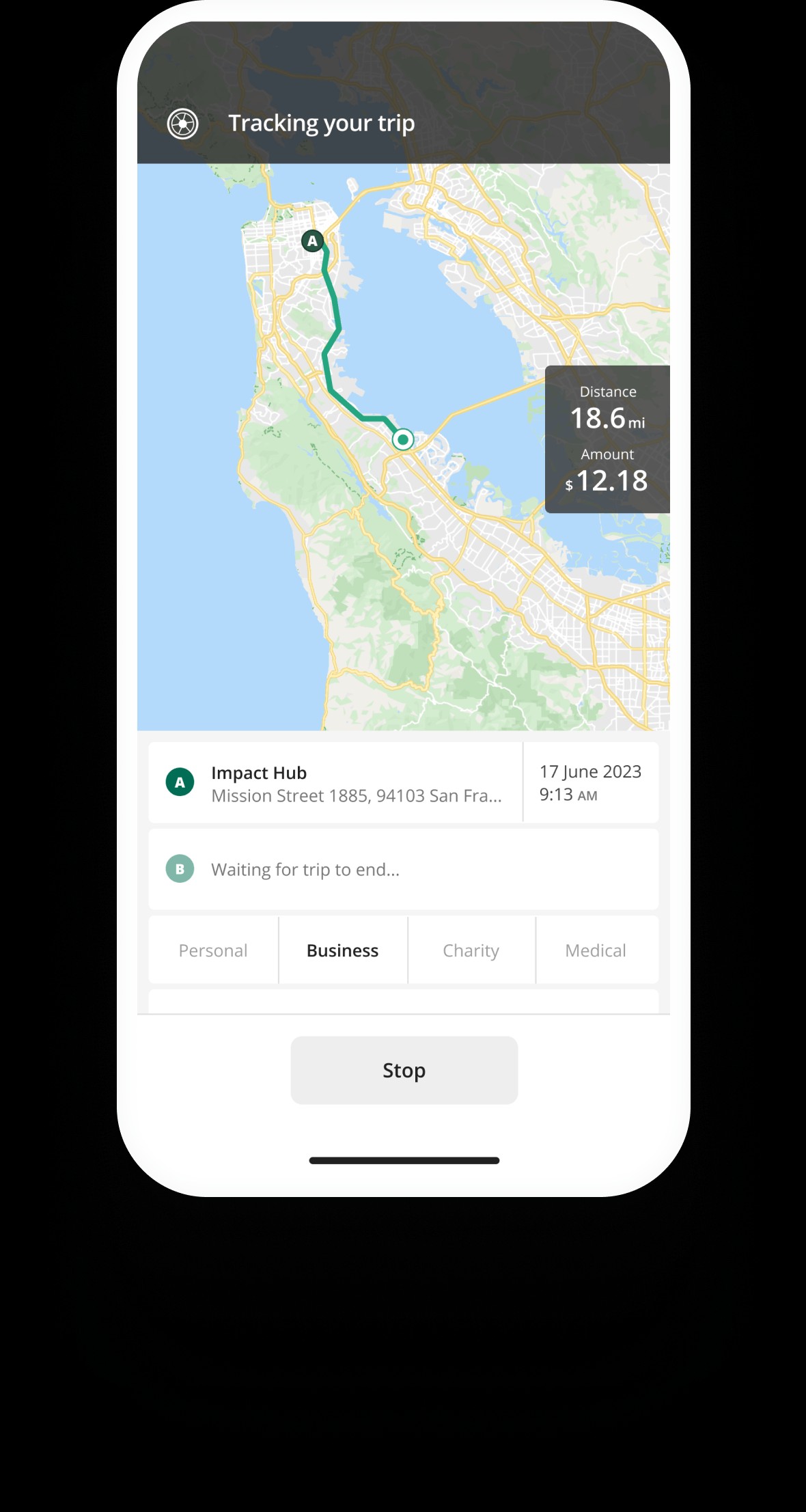

Tracking Business Mileage

Tracking Business Mileage

4. What Records Should You Keep for Car Repair Tax Deductions?

What records do you need to substantiate your auto repair tax deductions? Keeping detailed records is essential for claiming accurate deductions and avoiding issues with the IRS.

Here’s a list of records you should maintain:

- Mileage Log: Record the date, purpose, and miles driven for each business trip. Apps like Driversnote can automate this process.

- Receipts: Keep receipts for all car repair and maintenance expenses, including oil changes, tire replacements, and other services.

- Invoices: Retain invoices for any repairs or services performed on your vehicle.

- Vehicle Purchase or Lease Documents: Keep records of when you purchased or leased the vehicle.

- Insurance Policies: Retain copies of your auto insurance policies.

- Registration Documents: Keep copies of your vehicle registration.

Tip: Organize your records throughout the year to make tax preparation easier.

5. What Are the Methods for Claiming Car Repair Tax Deductions?

What are the methods for deducting car repairs and vehicle expenses? There are two main methods for deducting car expenses: the standard mileage method and the actual expense method.

5.1. Standard Mileage Method

How does the standard mileage method work? The standard mileage method uses a set rate per mile for business miles driven during the tax year. For 2024, the IRS business mileage rate is 67 cents per mile.

Calculation: Business Miles x Standard Mileage Rate = Deduction

Example: If you drove 10,000 business miles, your deduction would be 10,000 x $0.67 = $6,700.

Pros:

- Simple to calculate

- Requires less record-keeping

Cons:

- May not result in the highest deduction if your actual expenses are high

- Restrictions on usage apply (e.g., you can’t use it if you’ve claimed depreciation on the vehicle in the past)

5.2. Actual Expense Method

What does the actual expense method entail? The actual expense method allows you to deduct the actual costs of operating your vehicle for business. This includes expenses like gas, oil, repairs, insurance, and depreciation.

Calculation: Determine the business-use percentage and multiply each expense by that percentage.

Example: If your business-use percentage is 60% and your total car repair costs are $2,000, your deduction would be $2,000 x 0.60 = $1,200.

Pros:

- Can result in a higher deduction if actual expenses are high

- More flexible for certain types of vehicles and businesses

Cons:

- Requires detailed record-keeping

- More complex to calculate

6. How to Choose Between the Standard Mileage and Actual Expense Methods?

How do you decide which deduction method is best for you? Consider the following factors when choosing between the standard mileage and actual expense methods:

- Record-Keeping: Are you diligent about keeping detailed records of all your car expenses? If not, the standard mileage method might be easier.

- Expense Amounts: Are your actual expenses (repairs, insurance, etc.) high? If so, the actual expense method could result in a larger deduction.

- Vehicle Usage: How often do you use your vehicle for business? If you drive a lot for business, the standard mileage method could be beneficial.

Tip: Calculate your deduction using both methods to see which one provides the greatest tax savings.

7. Where to Report Car Repair Tax Deductions?

Where do you report car repair tax deductions on your tax return? The specific form you use to report these deductions depends on your business structure.

- Self-Employed Individuals: Report car expenses on Schedule C (Profit or Loss From Business) of Form 1040.

- Partnerships: Report car expenses on Form 1065 (U.S. Return of Partnership Income).

- Corporations: Report car expenses on Form 1120 (U.S. Corporation Income Tax Return).

- S Corporations: Report car expenses on Form 1120-S (U.S. Income Tax Return for an S Corporation).

Note: Make sure to complete all relevant sections of the form and attach any required schedules or documentation.

8. Claiming Car Repair Tax Deductions as a DoorDash Driver

Can DoorDash drivers deduct car repair expenses? Yes, as a DoorDash driver, you are typically considered an independent contractor, which means you can deduct business-related vehicle expenses, including car repairs.

8.1. Tracking DoorDash Mileage

How should DoorDash drivers track their mileage? Accurate mileage tracking is crucial for maximizing your tax deductions as a DoorDash driver.

Here are some tips for tracking your mileage:

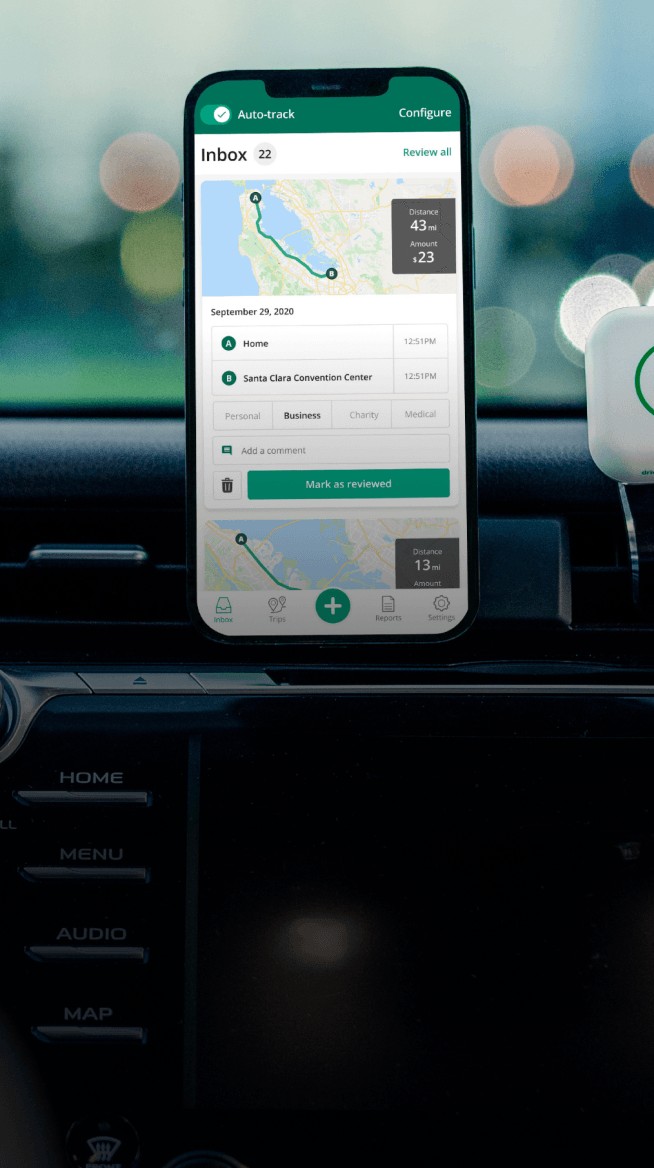

- Use a Mileage Tracking App: Apps like Stride or Everlance can automatically track your miles.

- Keep a Detailed Log: If you prefer not to use an app, keep a written log of each trip, including the date, purpose, and miles driven.

- Record Start and End Locations: Note the starting and ending points of each delivery to ensure accurate mileage.

8.2. Deductible Expenses for DoorDash Drivers

What expenses can DoorDash drivers deduct? In addition to car repairs, DoorDash drivers can deduct other vehicle-related expenses, such as:

- Gas and Oil: Fuel costs for deliveries.

- Maintenance: Routine maintenance like oil changes and tire rotations.

- Insurance: The portion of your insurance premiums related to business use.

- Depreciation: If you own the vehicle, you might be able to deduct depreciation.

8.3. Filing DoorDash Car Expenses

Where do DoorDash drivers report their car expenses? DoorDash drivers report their car expenses on Schedule C of Form 1040, just like other self-employed individuals.

9. What Are Common Mistakes to Avoid When Claiming Auto Repair Tax Deductions?

What are some common errors to avoid when deducting car expenses? Avoiding common mistakes can help you ensure accurate tax filings and minimize the risk of an audit.

Here are some mistakes to watch out for:

- Not Tracking Mileage: Failing to keep accurate records of business mileage can lead to missed deductions.

- Mixing Business and Personal Expenses: Claiming personal expenses as business expenses is a red flag for the IRS.

- Not Keeping Receipts: Lacking proper documentation can make it difficult to substantiate your deductions if audited.

- Choosing the Wrong Deduction Method: Using the wrong method (standard mileage vs. actual expense) can result in a lower deduction.

- Exceeding Deduction Limits: Being aware of any limitations or caps on certain deductions.

10. How Can AUTO-REPAIR-TRAINING.EDU.VN Help You Maximize Your Auto Repair Tax Deductions?

How can AUTO-REPAIR-TRAINING.EDU.VN assist with tax deductions and career advancement? AUTO-REPAIR-TRAINING.EDU.VN is dedicated to providing valuable resources and training to help you excel in the automotive industry.

10.1. Comprehensive Training Programs

What training programs does AUTO-REPAIR-TRAINING.EDU.VN offer? AUTO-REPAIR-TRAINING.EDU.VN provides comprehensive training programs designed to enhance your skills and knowledge in auto repair. These programs cover a wide range of topics, including:

- Basic Auto Repair: Foundational knowledge for beginners.

- Advanced Diagnostics: Techniques for diagnosing complex automotive issues.

- Engine Repair: Hands-on training in engine maintenance and repair.

- Electrical Systems: Understanding and troubleshooting vehicle electrical systems.

10.2. Business and Financial Resources

Does AUTO-REPAIR-TRAINING.EDU.VN offer financial guidance for auto repair professionals? AUTO-REPAIR-TRAINING.EDU.VN offers valuable resources to help you manage your finances and grow your business. These resources include:

- Tax Deduction Guides: Detailed guides on maximizing your tax deductions, including auto repair expenses.

- Financial Planning Tips: Advice on budgeting, saving, and investing.

- Business Planning Tools: Tools for creating a solid business plan, including financial projections and market analysis.

10.3. Career Advancement Support

How does AUTO-REPAIR-TRAINING.EDU.VN support career advancement? AUTO-REPAIR-TRAINING.EDU.VN is committed to helping you achieve your career goals in the automotive industry. We provide:

- Job Placement Assistance: Connections to potential employers and job opportunities.

- Resume and Interview Coaching: Guidance on crafting a compelling resume and acing your job interviews.

- Networking Opportunities: Opportunities to connect with other professionals in the industry.

Maximize Tax Deductions

Maximize Tax Deductions

FAQ About Auto Repair Tax Deductions

1. Can I deduct car repairs if I use the standard mileage method?

Yes, you can deduct certain car-related expenses even when using the standard mileage method. While the standard mileage rate covers gas, oil, and depreciation, you can separately deduct expenses like parking fees and tolls, provided they are business-related.

2. What if I don’t have receipts for all my car repairs?

While having receipts is ideal, you can still deduct car repairs without them if you have other forms of documentation. Bank statements, credit card statements, or detailed logs can help substantiate your expenses. However, the more documentation you have, the better.

3. Can I deduct car repairs if I lease my vehicle?

Yes, if you lease your vehicle and use it for business purposes, you can deduct a portion of your lease payments. The deductible amount is based on the percentage of business use. Keep detailed records of your mileage to accurately calculate this percentage.

4. Are there any limits to how much I can deduct for car repairs?

There is no specific limit on the amount you can deduct for car repairs, as long as the expenses are ordinary, necessary, and related to your business. However, it’s essential to keep accurate records and only deduct the portion of expenses related to business use.

5. Can I deduct the cost of a car accident repair?

Yes, if the accident occurred while you were using your vehicle for business purposes, the repair costs are deductible. Keep records of the accident report, repair invoices, and any insurance settlements.

6. What if I use my car for both business and personal use?

If you use your car for both business and personal purposes, you must allocate your expenses accordingly. The deductible amount is based on the percentage of business use. Keep accurate mileage records to determine this percentage.

7. How do I handle depreciation when deducting car expenses?

Depreciation can be a bit complex, but it’s an important part of deducting car expenses. If you use the actual expense method, you can deduct the depreciation of your vehicle over several years. Consult IRS Publication 946 (How to Depreciate Property) for detailed guidance.

8. Can I deduct expenses for a vehicle I don’t own?

Generally, you can only deduct expenses for a vehicle that you own or lease. However, if you use a personal vehicle for business purposes and are not reimbursed by your employer, you may be able to deduct these expenses as an employee business expense, subject to certain limitations.

9. What if I’m audited and the IRS disallows my car repair deductions?

If the IRS disallows your car repair deductions during an audit, you have the right to appeal their decision. Provide any additional documentation or evidence to support your deductions. If necessary, consult with a tax professional or attorney to help you navigate the appeals process.

10. Where can I find more information about car repair tax deductions?

For more information about car repair tax deductions, consult the following resources:

- IRS Publication 463 (Travel, Gift, and Car Expenses)

- IRS Publication 535 (Business Expenses)

- AUTO-REPAIR-TRAINING.EDU.VN Tax Deduction Guides

- Qualified Tax Professional or Accountant

Navigating auto repair tax deductions can be complex, but with the right knowledge and resources, you can maximize your savings. AUTO-REPAIR-TRAINING.EDU.VN is here to support you with comprehensive training programs, financial resources, and career advancement opportunities.

Ready to take control of your financial future? Contact AUTO-REPAIR-TRAINING.EDU.VN today for personalized guidance on maximizing your auto repair tax deductions and advancing your career in the automotive industry. Our office is located at 200 N Michigan Ave, Suite 1500, Chicago, IL 60601, United States. You can also reach us via WhatsApp at +1 (641) 206-8880 or visit our website at AUTO-REPAIR-TRAINING.EDU.VN. Let us help you drive your success!