Are you searching for an efficient way to manage your auto repair shop’s invoicing? An Auto Repair Invoice Template Excel offers a cost-effective and reliable solution to streamline transactions and enhance your business’s financial management, and AUTO-REPAIR-TRAINING.EDU.VN is here to guide you. Discover how using a customizable template, focusing on key information like vehicle details and service descriptions, can significantly improve your operational efficiency, paving the way for a successful auto repair career and potential entrepreneurship using essential business tools, strategies for ASE certification, detailed business plan creation, and step-by-step guides.

Contents

- 1. Understanding the Importance of an Auto Repair Invoice Template Excel

- 1.1. Streamlining Business Operations

- 1.2. Enhancing Customer Communication

- 2. Key Components of an Effective Auto Repair Invoice Template Excel

- 2.1. Essential Business and Customer Information

- 2.2. Detailing Services and Parts

- 2.3. Calculating Costs and Taxes

- 3. Customizing Your Auto Repair Invoice Template Excel

- 3.1. Incorporating Your Brand Identity

- 3.2. Adjusting Fields to Match Your Services

- 3.3. Setting Up Automated Calculations

- 4. Tips for Using Your Auto Repair Invoice Template Excel Effectively

- 4.1. Maintaining Data Accuracy

- 4.2. Training Staff for Consistent Usage

- 4.3. Backing Up Your Invoice Data

- 5. Advantages of Using Excel for Auto Repair Invoices

- 5.1. Cost-Effective Solution

- 5.2. Customizable Features

- 5.3. Data Management Capabilities

- 6. Common Mistakes to Avoid When Using an Auto Repair Invoice Template Excel

- 6.1. Inaccurate Data Entry

- 6.2. Neglecting Template Updates

- 6.3. Ignoring Data Validation

- 7. Enhancing Efficiency with Advanced Excel Features

- 7.1. Automating Tasks with Macros

- 7.2. Analyzing Data with Pivot Tables

- 7.3. Highlighting Information with Conditional Formatting

- 8. Integrating Your Auto Repair Invoice Template Excel with Other Tools

- 8.1. Connecting with Accounting Software

- 8.2. Linking with CRM Systems

1. Understanding the Importance of an Auto Repair Invoice Template Excel

Why is an auto repair invoice template excel crucial for your business? Using a dedicated template ensures accuracy, efficiency, and a professional image, which are essential for maintaining customer trust and managing finances effectively.

An auto repair invoice template in excel is more than just a bill; it’s a cornerstone of your business’s financial and operational health. Here’s why it’s indispensable:

- Professionalism: A well-structured invoice presents a professional image of your business, enhancing customer trust and confidence.

- Accuracy: Templates help ensure all necessary information is captured, reducing errors and disputes.

- Efficiency: Automating calculations and data entry saves time, allowing you to focus on core business activities.

- Financial Tracking: Organized invoices are essential for tracking revenue, managing taxes, and making informed business decisions.

- Legal Compliance: Properly documented invoices can help you comply with legal and regulatory requirements.

1.1. Streamlining Business Operations

How does an invoice template streamline operations? By automating calculations, providing a standardized format, and reducing manual errors, it significantly enhances productivity and accuracy.

An auto repair invoice template excel streamlines various aspects of your business operations. By integrating all necessary elements into a single, easy-to-use document, it minimizes the time spent on administrative tasks, allowing you to focus more on vehicle repairs and customer service. Here are several ways it enhances your business:

- Efficient Data Entry: Streamlines the process of inputting customer and vehicle information.

- Automated Calculations: Automatically calculates totals, taxes, and discounts, reducing manual errors.

- Standardized Format: Ensures all invoices are consistent, creating a professional image for your business.

- Quick Retrieval: Makes it easier to find and review past invoices for customer inquiries or financial audits.

- Inventory Management: Helps track the use of parts and supplies, aiding in inventory control.

1.2. Enhancing Customer Communication

How does a well-designed invoice improve customer relations? It provides clear, concise information, fostering transparency and trust, which leads to increased customer satisfaction and repeat business.

A well-structured auto repair invoice enhances customer communication by providing transparency and clarity in billing. Customers appreciate knowing exactly what they are paying for, which builds trust and fosters long-term relationships. Here’s how it improves customer relations:

- Detailed Breakdown: Clearly lists all services performed, parts used, and associated costs.

- Transparent Pricing: Provides a clear breakdown of labor rates, part prices, and taxes.

- Professional Presentation: Presents information in a clear, organized manner, making it easy for customers to understand.

- Accurate Information: Reduces disputes by ensuring all details are accurate and consistent.

- Personalized Service: Allows for the inclusion of notes or explanations, providing a personal touch.

2. Key Components of an Effective Auto Repair Invoice Template Excel

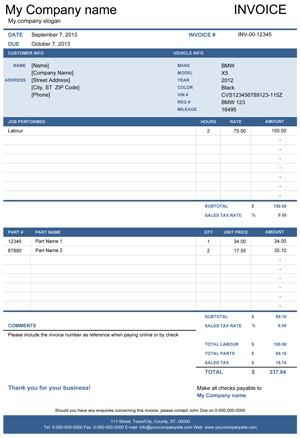

What elements should you include in your invoice template? Essential components include business information, customer details, vehicle specifics, a breakdown of services and parts, and clear pricing, ensuring all transactions are accurately recorded.

An effective auto repair invoice template excel should include several key components to ensure accuracy, clarity, and professionalism. These elements not only help in managing your business efficiently but also enhance customer satisfaction by providing a clear and comprehensive record of the services provided. Here are the essential components:

- Business Information:

- Business Name

- Address

- Phone Number

- Email Address

- Logo (Optional)

- Invoice Details:

- Invoice Number (Unique identifier for tracking)

- Invoice Date

- Due Date

- Customer Information:

- Customer Name

- Address

- Phone Number

- Email Address

- Vehicle Information:

- Vehicle Make

- Vehicle Model

- Year

- VIN (Vehicle Identification Number)

- License Plate Number

- Service Details:

- Description of Services Performed

- Labor Hours

- Hourly Rate

- Labor Cost

- Parts Details:

- Part Number

- Description of Parts Used

- Quantity

- Unit Price

- Total Cost

- Financial Summary:

- Subtotal (Cost of services and parts before taxes)

- Tax Rate(s)

- Tax Amount(s)

- Discounts (If applicable)

- Total Amount Due

- Payment Terms:

- Accepted Payment Methods

- Payment Due Date

- Late Payment Policy (If applicable)

- Additional Notes:

- Warranty Information

- Technician Notes

- Special Instructions or Comments

By including these components in your auto repair invoice template excel, you ensure that all necessary information is captured accurately, making it easier to manage your business, track financials, and provide excellent customer service.

2.1. Essential Business and Customer Information

Why is accurate business and customer data vital? Correct details ensure proper billing, communication, and record-keeping, which are crucial for financial accuracy and customer satisfaction.

Accurate business and customer information is vital for several reasons, all contributing to the smooth operation of your auto repair shop and the maintenance of strong customer relationships. Here’s why:

- Accurate Billing: Ensures invoices are sent to the correct customer and address, reducing billing errors and delays.

- Effective Communication: Enables easy contact with customers for updates, approvals, and follow-ups.

- Professional Record-Keeping: Maintains organized and reliable records for financial reporting and tax purposes.

- Legal Compliance: Helps comply with legal requirements for invoicing and customer data protection.

- Customer Satisfaction: Shows attention to detail and professionalism, enhancing customer trust and loyalty.

2.2. Detailing Services and Parts

How should you detail services and parts on an invoice? Provide clear descriptions, quantities, and prices for each item, which helps prevent misunderstandings and builds trust with customers.

Detailing services and parts on an auto repair invoice is crucial for maintaining transparency and building trust with your customers. A clear and comprehensive breakdown of each item helps prevent misunderstandings and ensures that customers understand exactly what they are paying for. Here’s how to effectively detail services and parts:

- Clear Descriptions: Provide detailed descriptions of each service performed, using specific language that customers can understand.

- Quantities: Specify the quantity of each part used, especially for items like oil, fluids, or small components.

- Unit Prices: List the price of each individual item or service, allowing customers to see the cost breakdown.

- Total Costs: Calculate and display the total cost for each line item, ensuring accuracy and clarity.

- Categorization: Organize services and parts into separate sections to improve readability and understanding.

2.3. Calculating Costs and Taxes

What is the best approach for cost and tax calculations? Use automated formulas in excel to ensure accuracy, which simplifies financial management and minimizes errors.

Using automated formulas in excel for cost and tax calculations is the best approach for several reasons. Automation not only ensures accuracy but also saves time and reduces the risk of manual errors, which is crucial for efficient financial management. Here’s why automated formulas are essential:

- Accuracy: Formulas ensure that calculations are precise, reducing the risk of errors that can lead to billing disputes or financial inaccuracies.

- Efficiency: Excel automatically updates totals and taxes whenever changes are made, saving time and effort.

- Consistency: Formulas ensure that the same calculation methods are used across all invoices, maintaining consistency in billing.

- Flexibility: Excel allows you to easily adjust tax rates or pricing without having to manually recalculate each invoice.

- Professionalism: Accurate and consistent calculations enhance the professional image of your business.

3. Customizing Your Auto Repair Invoice Template Excel

How can you tailor the template to your business? Add your logo, adjust color schemes, and modify fields to match your specific services and branding, creating a unique and professional document.

Customizing your auto repair invoice template excel is essential for creating a unique and professional document that reflects your brand and meets your specific business needs. By tailoring the template, you can enhance your brand identity, improve customer perception, and streamline your invoicing process. Here’s how to customize your template:

- Add Your Logo:

- Insert your company logo to reinforce your brand identity.

- Place the logo in a prominent location, such as the header of the invoice.

- Adjust Color Schemes:

- Modify the color scheme to match your brand colors.

- Use colors that are professional and easy on the eyes.

- Modify Fields:

- Add or remove fields to match the specific services your shop offers.

- Customize labels to use terminology that is familiar to your customers.

- Incorporate Payment Terms:

- Clearly state your payment terms, including accepted methods and due dates.

- Add any late payment policies or fees.

- Include Additional Notes:

- Add a section for notes to include warranty information, special instructions, or technician comments.

3.1. Incorporating Your Brand Identity

Why is branding important on invoices? It reinforces your company’s image, builds recognition, and fosters customer loyalty, which can lead to increased business and positive word-of-mouth referrals.

Incorporating your brand identity on invoices is crucial for reinforcing your company’s image, building recognition, and fostering customer loyalty. A branded invoice serves as a consistent reminder of your business, helping to solidify your brand in the customer’s mind. Here’s why branding is important on invoices:

- Reinforces Brand Image: Consistent use of your logo and brand colors helps reinforce your company’s identity.

- Builds Recognition: Regular exposure to your brand elements helps customers recognize and remember your business.

- Fosters Customer Loyalty: A professional and consistent brand image can increase customer trust and loyalty.

- Enhances Professionalism: A well-branded invoice enhances the overall perception of your business.

- Marketing Opportunity: Invoices can serve as a subtle marketing tool, reminding customers of your services.

3.2. Adjusting Fields to Match Your Services

How do you modify fields effectively? Tailor the template to include specific services, labor rates, and part categories that align with your shop’s offerings, which ensures accurate and relevant invoicing.

Adjusting fields in your auto repair invoice template excel to match your services is essential for ensuring that the invoice accurately reflects the work performed at your shop. By tailoring the template to include specific services, labor rates, and part categories, you can create a more efficient and accurate invoicing process. Here’s how to modify fields effectively:

- Include Specific Services: Add fields for the specific services your shop offers, such as oil changes, brake repairs, or engine diagnostics.

- Customize Labor Rates: Adjust the template to accommodate different labor rates for various types of work.

- Categorize Parts: Create categories for different types of parts, such as engine parts, brake parts, or electrical components.

- Add Custom Fields: Include custom fields for unique services or parts that are specific to your shop.

- Remove Unnecessary Fields: Remove any fields that are not relevant to your business to streamline the invoice.

3.3. Setting Up Automated Calculations

How do you create automated calculations in excel? Use formulas to automatically calculate totals, taxes, and discounts, which significantly reduces manual effort and errors.

Setting up automated calculations in excel is essential for ensuring accuracy and efficiency in your invoicing process. By using formulas to automatically calculate totals, taxes, and discounts, you can significantly reduce manual effort and minimize the risk of errors. Here’s how to create automated calculations:

- Calculate Subtotals: Use the

SUMfunction to calculate the subtotal of services and parts. - Calculate Taxes: Apply a tax rate to the subtotal using a formula like

=[Subtotal]*[Tax Rate]. - Apply Discounts: Subtract any discounts from the subtotal using a formula like

=[Subtotal]-[Discount]. - Calculate Total Amount Due: Sum the subtotal, taxes, and discounts to calculate the total amount due.

- Format Cells: Format cells as currency to ensure that all amounts are displayed correctly.

Auto Repair Invoice Sample

Auto Repair Invoice Sample

4. Tips for Using Your Auto Repair Invoice Template Excel Effectively

What are some best practices for using the template? Regularly update your template, train staff on proper usage, and back up your data to prevent loss, which helps ensure consistent and reliable invoicing.

To use your auto repair invoice template excel effectively, it’s important to follow some best practices that ensure consistency, accuracy, and efficiency. These tips will help you streamline your invoicing process, reduce errors, and maintain a professional image. Here are some key recommendations:

- Regularly Update Your Template:

- Keep your template up-to-date with current tax rates, pricing, and business information.

- Periodically review and update the layout to ensure it meets your evolving needs.

- Train Staff on Proper Usage:

- Provide comprehensive training to all staff members who will be using the template.

- Ensure they understand how to accurately input data and perform calculations.

- Back Up Your Data:

- Regularly back up your invoice data to prevent loss in case of system failures or other issues.

- Store backups in a secure location, preferably offsite.

- Use Clear and Consistent Descriptions:

- Use clear and consistent descriptions for services and parts to avoid confusion.

- Maintain a standardized list of services and parts to ensure consistency across all invoices.

- Review Invoices Before Sending:

- Always review invoices for accuracy before sending them to customers.

- Check for any errors in pricing, calculations, or customer information.

- Utilize Excel Features:

- Take advantage of Excel features such as data validation, conditional formatting, and formulas to improve accuracy and efficiency.

- Use data validation to ensure that only valid entries are entered in certain fields.

4.1. Maintaining Data Accuracy

How can you ensure accuracy in your invoices? Implement data validation, double-check entries, and regularly audit your records, which helps prevent errors and maintains financial integrity.

Maintaining data accuracy in your invoices is crucial for preventing errors, ensuring financial integrity, and maintaining customer trust. Inaccurate invoices can lead to disputes, lost revenue, and damage to your business’s reputation. Here are several strategies to ensure accuracy:

- Implement Data Validation:

- Use Excel’s data validation feature to restrict the type of data that can be entered into certain fields.

- For example, you can set up data validation to ensure that only numbers are entered in quantity and price fields.

- Double-Check Entries:

- Always double-check entries before finalizing an invoice.

- Pay close attention to customer information, vehicle details, service descriptions, and pricing.

- Regularly Audit Your Records:

- Conduct regular audits of your invoice records to identify and correct any errors.

- Compare invoices against work orders and other documentation to ensure consistency.

- Use Consistent Descriptions:

- Maintain a standardized list of services and parts to ensure consistent descriptions across all invoices.

- This helps prevent confusion and ensures that customers understand exactly what they are paying for.

- Train Staff Thoroughly:

- Provide comprehensive training to all staff members who are responsible for creating invoices.

- Ensure they understand the importance of accuracy and the steps they can take to prevent errors.

4.2. Training Staff for Consistent Usage

Why is staff training essential? Properly trained staff ensures consistent and accurate invoice creation, which reduces errors and improves overall efficiency.

Staff training is essential for ensuring consistent and accurate invoice creation, which in turn reduces errors and improves overall efficiency. Properly trained staff members are more likely to understand the importance of accuracy and follow established procedures, leading to more reliable and professional invoices. Here’s why staff training is crucial:

- Ensures Consistency: Training ensures that all staff members follow the same procedures and use the same standards when creating invoices.

- Reduces Errors: Well-trained staff members are less likely to make mistakes, reducing the risk of errors in pricing, calculations, or customer information.

- Improves Efficiency: Trained staff members can create invoices more quickly and efficiently, saving time and improving productivity.

- Enhances Professionalism: Accurate and consistent invoices enhance the professional image of your business.

- Increases Confidence: Training gives staff members the confidence to handle invoicing tasks effectively.

4.3. Backing Up Your Invoice Data

Why is data backup critical? It protects against data loss due to system failures, cyber threats, or human error, which ensures business continuity and data recovery.

Data backup is critical for protecting against data loss due to system failures, cyber threats, or human error. Losing your invoice data can have severe consequences, including financial losses, compliance issues, and damage to your business’s reputation. Here’s why data backup is essential:

- Protects Against System Failures: Hardware failures, software glitches, or power outages can result in data loss. Regular backups ensure that you can quickly recover your data in the event of a system failure.

- Safeguards Against Cyber Threats: Cyberattacks, such as ransomware, can encrypt or delete your data. Backups provide a way to restore your data without paying a ransom or losing critical information.

- Mitigates Human Error: Accidental deletion or modification of invoice data can occur. Backups allow you to revert to a previous version of your data, minimizing the impact of human error.

- Ensures Business Continuity: Data loss can disrupt your business operations. Backups enable you to quickly restore your data and resume normal operations.

- Facilitates Data Recovery: In the event of data loss, backups provide a reliable way to recover your data and minimize downtime.

5. Advantages of Using Excel for Auto Repair Invoices

What are the benefits of using excel for invoicing? Excel offers customization, automation, and compatibility, making it a versatile tool for managing invoices efficiently.

Using excel for auto repair invoices offers numerous advantages, making it a versatile and efficient tool for managing your business’s invoicing needs. Excel provides a familiar and customizable environment that can be tailored to your specific requirements, offering benefits such as automation, compatibility, and cost-effectiveness. Here are some key advantages:

- Customization:

- Excel allows you to customize your invoice template to match your brand and specific business needs.

- You can add your logo, adjust color schemes, and modify fields to create a professional and unique invoice.

- Automation:

- Excel supports automated calculations through the use of formulas and functions.

- You can set up formulas to automatically calculate totals, taxes, and discounts, reducing manual effort and errors.

- Compatibility:

- Excel is widely compatible with various operating systems and devices.

- You can easily share your invoices with customers and other stakeholders, regardless of their preferred software.

- Cost-Effectiveness:

- Excel is a cost-effective solution for managing invoices, especially if you already have a Microsoft Office subscription.

- There are also many free excel templates available online that you can use as a starting point.

- Data Management:

- Excel provides powerful data management capabilities.

- You can easily organize and analyze your invoice data to track revenue, identify trends, and make informed business decisions.

5.1. Cost-Effective Solution

Why is excel a cost-effective choice? It eliminates the need for expensive accounting software, which makes it an affordable option for small businesses.

Excel is a cost-effective choice for managing auto repair invoices because it eliminates the need for expensive accounting software and provides a familiar and customizable environment for creating and managing invoices. This makes it an affordable option, particularly for small businesses and startups, that are keen on managing their financials without incurring huge expenses. Here are the reasons why Excel is a cost-effective solution:

- No Subscription Fees: Unlike many accounting software options that require monthly or annual subscription fees, Excel is often a one-time purchase as part of the Microsoft Office suite.

- Reduced Software Costs: By using Excel for invoicing, you can avoid the need to purchase specialized accounting software, saving your business a significant amount of money.

- Free Templates: There are many free Excel invoice templates available online, which can be used as a starting point for creating your own customized invoice template.

- Minimal Training Costs: Most people have some familiarity with Excel, so the training costs for staff to use Excel for invoicing are minimal compared to learning a new accounting software.

- Scalable Solution: Excel can be used to manage invoices for businesses of all sizes, making it a scalable solution that can grow with your business.

5.2. Customizable Features

How does excel offer customization? You can tailor templates to match your branding, adjust fields to fit your services, and set up automated calculations, which results in a unique and efficient invoicing system.

Excel offers extensive customization options that allow you to tailor templates to match your branding, adjust fields to fit your services, and set up automated calculations. This high degree of customization results in a unique and efficient invoicing system that meets the specific needs of your auto repair business. Here’s how Excel provides customization:

- Branding Options: You can add your company logo, adjust color schemes, and use custom fonts to match your brand identity.

- Field Adjustments: Excel allows you to add, remove, or modify fields to include the specific information that is relevant to your business.

- Automated Calculations: You can set up formulas to automatically calculate totals, taxes, and discounts, reducing manual effort and ensuring accuracy.

- Layout Customization: Excel provides a variety of layout options, allowing you to design your invoice to be visually appealing and easy to read.

- Data Validation: You can use data validation to ensure that only valid entries are entered in certain fields, improving data accuracy and consistency.

5.3. Data Management Capabilities

What data management tools does excel provide? Excel allows you to organize, sort, and analyze invoice data, which helps you track revenue, identify trends, and make informed business decisions.

Excel provides robust data management capabilities that allow you to organize, sort, and analyze invoice data. These tools enable you to track revenue, identify trends, and make informed business decisions, making Excel a valuable asset for managing your auto repair business. Here’s how Excel helps with data management:

- Data Organization: Excel allows you to organize your invoice data in a structured format, making it easy to find and retrieve information.

- Sorting and Filtering: You can sort and filter your invoice data to analyze specific aspects of your business, such as revenue by customer or service type.

- Data Analysis: Excel provides a variety of data analysis tools, such as charts and graphs, that can help you visualize trends and patterns in your invoice data.

- Reporting: You can use Excel to generate reports on your invoice data, providing valuable insights into your business’s financial performance.

- Data Storage: Excel provides a secure and reliable way to store your invoice data, ensuring that it is protected from loss or corruption.

6. Common Mistakes to Avoid When Using an Auto Repair Invoice Template Excel

What are some common errors to watch out for? Overlooking data validation, neglecting regular backups, and failing to update the template can lead to inaccuracies and data loss.

When using an auto repair invoice template excel, it’s important to be aware of common mistakes that can lead to inaccuracies, data loss, or other issues. Avoiding these errors will help you maintain a professional and efficient invoicing process. Here are some common mistakes to watch out for:

- Overlooking Data Validation: Failing to use data validation can result in inconsistent or inaccurate data entries.

- Neglecting Regular Backups: Neglecting to back up your invoice data can lead to data loss in case of system failures, cyber threats, or human error.

- Failing to Update the Template: Failing to update your template with current tax rates, pricing, and business information can lead to inaccurate invoices.

- Using Inconsistent Descriptions: Using inconsistent descriptions for services and parts can lead to confusion and disputes with customers.

- Not Reviewing Invoices Before Sending: Failing to review invoices for accuracy before sending them to customers can result in errors and damage to your business’s reputation.

- Ignoring Excel Features: Not taking advantage of Excel features such as formulas, functions, and conditional formatting can limit the efficiency of your invoicing process.

6.1. Inaccurate Data Entry

Why is accurate data entry crucial? Errors in invoices can lead to billing disputes, financial miscalculations, and a loss of customer trust.

Accurate data entry is crucial for several reasons, all of which impact the financial health and reputation of your auto repair business. Inaccurate invoices can lead to billing disputes, financial miscalculations, and a loss of customer trust. Here’s why accurate data entry is essential:

- Prevents Billing Disputes: Accurate invoices ensure that customers are billed correctly, reducing the likelihood of disputes.

- Ensures Financial Accuracy: Accurate data entry is essential for maintaining accurate financial records.

- Maintains Customer Trust: Accurate invoices demonstrate professionalism and attention to detail, building trust with customers.

- Avoids Legal Issues: Inaccurate invoices can lead to legal issues, such as tax violations or breach of contract claims.

- Improves Efficiency: Accurate data entry reduces the need for rework and corrections, improving efficiency.

6.2. Neglecting Template Updates

What happens if you don’t update your template? Outdated information can lead to incorrect pricing, tax calculations, and compliance issues.

Failing to update your auto repair invoice template excel can lead to several problems, including incorrect pricing, tax calculations, and compliance issues. Keeping your template up-to-date is essential for ensuring accuracy and maintaining a professional image. Here’s what happens if you neglect template updates:

- Incorrect Pricing: Outdated pricing can lead to underbilling or overbilling customers, both of which can damage your business’s reputation.

- Inaccurate Tax Calculations: Tax rates change periodically, and failing to update your template can result in inaccurate tax calculations.

- Compliance Issues: Inaccurate invoices can lead to compliance issues, such as tax violations or breach of contract claims.

- Loss of Credibility: Using an outdated template can make your business appear unprofessional and out of touch.

- Missed Opportunities: Updated templates may include new features or fields that can improve your invoicing process.

6.3. Ignoring Data Validation

Why is data validation important? It helps prevent errors by restricting the type of data entered, which leads to more accurate and reliable invoices.

Data validation is important because it helps prevent errors by restricting the type of data that can be entered into certain fields, leading to more accurate and reliable invoices. By setting up data validation rules, you can ensure that only valid entries are entered, reducing the risk of mistakes and improving the overall quality of your data. Here’s why data validation is crucial:

- Prevents Errors: Data validation helps prevent errors by restricting the type of data that can be entered into certain fields.

- Ensures Consistency: Data validation ensures that data is entered in a consistent format, making it easier to analyze and manage.

- Improves Accuracy: Data validation helps improve the accuracy of your invoice data, reducing the risk of mistakes.

- Enhances Efficiency: Data validation can save time by preventing the need to correct errors later on.

- Simplifies Data Analysis: Consistent and accurate data makes it easier to analyze your invoice data.

7. Enhancing Efficiency with Advanced Excel Features

How can advanced features improve invoicing? Using features like macros, pivot tables, and conditional formatting can automate tasks, analyze data, and highlight important information, leading to greater efficiency.

Enhancing efficiency with advanced excel features can significantly improve your invoicing process. By using features like macros, pivot tables, and conditional formatting, you can automate tasks, analyze data, and highlight important information, leading to greater efficiency and better business insights. Here’s how these advanced features can help:

- Macros:

- Macros can automate repetitive tasks, such as generating invoices or sending email notifications.

- By recording a series of actions as a macro, you can quickly repeat those actions with a single click.

- Pivot Tables:

- Pivot tables can summarize and analyze large amounts of invoice data, providing valuable insights into your business’s financial performance.

- You can use pivot tables to track revenue, identify trends, and analyze customer behavior.

- Conditional Formatting:

- Conditional formatting can highlight important information on your invoices, such as overdue payments or high-value customers.

- By setting up conditional formatting rules, you can quickly identify and address key issues.

- Data Validation:

- Data validation can help prevent errors by restricting the type of data that can be entered into certain fields.

- You can use data validation to ensure that only valid entries are entered in quantity, price, and other critical fields.

- Formulas and Functions:

- Excel provides a wide range of formulas and functions that can automate calculations and perform complex data analysis.

- You can use formulas to calculate totals, taxes, and discounts, and functions to analyze invoice data.

7.1. Automating Tasks with Macros

How do macros streamline invoicing? They automate repetitive actions like data entry, invoice creation, and email notifications, saving time and reducing manual effort.

Macros streamline invoicing by automating repetitive actions such as data entry, invoice creation, and email notifications. By recording a series of actions as a macro, you can quickly repeat those actions with a single click, saving time and reducing manual effort. Here’s how macros can help:

- Data Entry: Macros can automate the process of entering customer information, vehicle details, and service descriptions into your invoices.

- Invoice Creation: Macros can automate the process of creating new invoices based on pre-defined templates and data.

- Email Notifications: Macros can automate the process of sending email notifications to customers when their invoices are ready or overdue.

- Report Generation: Macros can automate the process of generating reports on your invoice data, providing valuable insights into your business’s financial performance.

- Data Backup: Macros can automate the process of backing up your invoice data, ensuring that it is protected from loss or corruption.

7.2. Analyzing Data with Pivot Tables

How do pivot tables enhance data analysis? They summarize large datasets, identify trends, and provide insights into customer behavior and financial performance, which aids in strategic decision-making.

Pivot tables enhance data analysis by summarizing large datasets, identifying trends, and providing insights into customer behavior and financial performance. By using pivot tables, you can quickly analyze your invoice data to gain a better understanding of your business and make more informed decisions. Here’s how pivot tables can help:

- Summarizing Data: Pivot tables can summarize large amounts of invoice data, providing a concise overview of your business’s financial performance.

- Identifying Trends: Pivot tables can help you identify trends in your invoice data, such as seasonal fluctuations in revenue or changes in customer behavior.

- Analyzing Customer Behavior: Pivot tables can help you analyze customer behavior, such as which services are most popular with different customer segments.

- Tracking Revenue: Pivot tables can help you track revenue by customer, service type, or time period, providing valuable insights into your business’s financial performance.

- Strategic Decision-Making: Pivot tables provide the information you need to make more informed decisions about pricing, marketing, and other strategic issues.

7.3. Highlighting Information with Conditional Formatting

How does conditional formatting improve invoice management? It highlights key data points, such as overdue payments, which allows for quick identification and action, and enhances overall efficiency.

Conditional formatting improves invoice management by highlighting key data points, such as overdue payments, which allows for quick identification and action, enhancing overall efficiency. By setting up conditional formatting rules, you can quickly identify and address important issues, such as unpaid invoices or high-value customers. Here’s how conditional formatting can help:

- Overdue Payments: Conditional formatting can highlight invoices that are overdue, allowing you to quickly identify and follow up on unpaid balances.

- High-Value Customers: Conditional formatting can highlight invoices from high-value customers, allowing you to prioritize their needs and provide excellent service.

- Large Invoices: Conditional formatting can highlight invoices that exceed a certain amount, allowing you to review them for accuracy and ensure that they are properly billed.

- Specific Services: Conditional formatting can highlight invoices that include specific services, allowing you to track the popularity of those services and adjust your pricing accordingly.

- Important Dates: Conditional formatting can highlight important dates, such as payment due dates or warranty expiration dates, helping you stay organized and avoid missed deadlines.

8. Integrating Your Auto Repair Invoice Template Excel with Other Tools

How can integration boost efficiency? Connecting your invoice template with accounting software or CRM systems streamlines data flow, reduces manual entry, and enhances overall business management.

Integrating your auto repair invoice template excel with other tools, such as accounting software or CRM systems, can significantly boost efficiency by streamlining data flow, reducing manual entry, and enhancing overall business management. Integration eliminates the need to manually transfer data between systems, saving time and reducing the risk of errors. Here’s how integration can help:

- Accounting Software:

- Integrating your invoice template with accounting software, such as QuickBooks or Xero, can automate the process of recording revenue and expenses.

- Invoices created in Excel can be automatically imported into your accounting software, eliminating the need for manual data entry.

- CRM Systems:

- Integrating your invoice template with a CRM system, such as Salesforce or HubSpot, can help you track customer interactions and manage customer relationships.

- Invoice data can be automatically synced with your CRM system, providing a comprehensive view of each customer’s history and preferences.

- Payment Gateways:

- Integrating your invoice template with a payment gateway, such as PayPal or Stripe, can make it easier for customers to pay their invoices online.

- Customers can click a link on their invoice to be directed to a secure payment page, where they can pay with a credit card or other payment method.

- Inventory Management Systems:

- Integrating your invoice template with an inventory management system can help you track the parts and supplies used in your auto repair shop.

- Invoice data can be automatically synced with your inventory management system, providing a real-time view of your inventory levels.

- Email Marketing Tools:

- Integrating your invoice template with an email marketing tool, such as Mailchimp or Constant Contact, can help you promote your business and stay in touch with customers.

- Customer email addresses can be automatically added to your email marketing list, allowing you to send targeted promotions and newsletters.

8.1. Connecting with Accounting Software

Why integrate with accounting software? It automates financial processes, ensures accurate record-keeping, and simplifies tax preparation.

Integrating your auto repair invoice template excel with accounting software automates financial processes, ensures accurate record-keeping, and simplifies tax preparation. This integration eliminates the need to manually transfer data between systems, saving time and reducing the risk of errors. Here’s why integrating with accounting software is beneficial:

- Automated Financial Processes: Integration automates many financial processes, such as recording revenue and expenses, reconciling bank statements, and generating financial reports.

- Accurate Record-Keeping: Integration ensures that your financial records are accurate and up-to-date, providing a reliable basis for decision-making.

- Simplified Tax Preparation: Integration simplifies tax preparation by providing accurate and organized financial data.

- Time Savings: Integration saves time by eliminating the need for manual data entry and reducing the amount of time spent on financial tasks.

- Reduced Errors: Integration reduces the risk of errors by automating data transfer and calculation processes.

8.2. Linking with CRM Systems

How does CRM integration benefit invoicing? It provides a holistic view of customer interactions, improves customer service, and enhances marketing efforts.

Linking your auto repair invoice template excel with a CRM system provides a holistic view of customer interactions